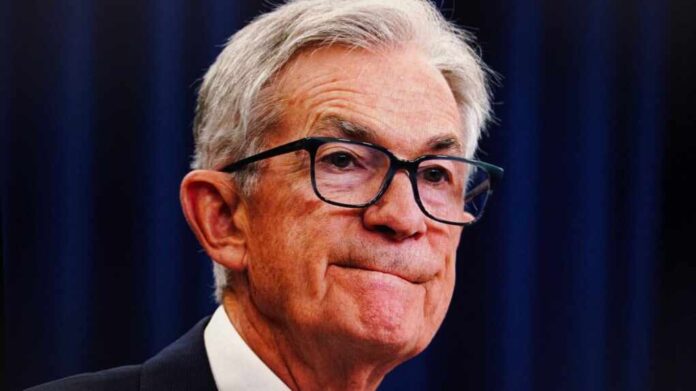

A criminal investigation into Fed Chair Jerome Powell complicates Trump’s push for lower interest rates, sparking debate over Fed independence and economic strategy.

Story Highlights

- Trump advocates for drastic interest rate cuts to stimulate economic growth.

- Federal Reserve independence and institutional hurdles challenge Trump’s agenda.

- A criminal investigation into Jerome Powell adds unprecedented pressure.

- Concerns arise over potential inflation from aggressive rate cuts.

Trump’s Rate Cut Advocacy and Challenges

President Donald Trump is intensifying his campaign for the Federal Reserve to slash interest rates, arguing that lower rates would spur economic growth and ease the federal borrowing burden. Trump’s push comes amid a federal debt of about $30 trillion, which he sees as a fiscal priority. Despite his determination, Trump’s ambitions face significant barriers, primarily due to the Federal Reserve’s independence and its decision-making structure, which limits direct executive control.

Since 2025, Trump has been vocal about his dissatisfaction with Fed Chair Jerome Powell’s cautious approach to rate cuts. Tensions between the executive branch and the Federal Reserve have escalated, particularly with the revelation of a criminal investigation into Powell. This investigation, coupled with Trump’s outspoken criticism, underscores the unique challenges faced by the administration in influencing Fed policy.

Watch:

The Role of the Federal Open Market Committee

The Federal Open Market Committee (FOMC), comprising 12 members, plays a crucial role in setting interest rates. Powell, while influential, is only one vote among many, making it difficult for any single chair to unilaterally shape policy. The FOMC’s collective decision-making structure serves as a safeguard against undue political influence, maintaining the Fed’s independence as a cornerstone of its credibility and effectiveness in managing monetary policy.

Trump’s ability to nominate a new Fed chair when Powell’s term ends in May 2026 offers a potential avenue for aligning the Fed’s leadership with his economic objectives. However, the broader economic conditions, such as labor market trends and inflation rates, continue to guide the FOMC’s decisions, which may not align with Trump’s aggressive timeline for rate reductions.

Economic Implications and Market Reactions

While Trump argues that lower interest rates will drive economic growth, experts caution that the proposed cuts could lead to inflationary pressures. This concern is echoed by financial analysts who warn that a drastic reduction in rates might inadvertently raise long-term interest rates, contrary to Trump’s intentions. The potential for increased inflation poses risks to the economy, potentially affecting consumers’ purchasing power and the affordability of loans.

Here are the hurdles Trump faces in his push for low interest rates and a friendly Fed: https://t.co/T8ItJgD21S

— CBS News (@CBSNews) January 17, 2026

Markets remain skeptical of Trump’s 1% interest rate target, with financial forecasts predicting only modest cuts in 2026. The criminal investigation into Powell adds another layer of complexity, casting doubt on the Fed’s ability to operate without political interference. As the administration navigates these challenges, the balance between economic growth and inflation control remains a critical concern for policymakers.

Sources:

Trump’s push for lower interest rates: A good idea?

Should the Fed cut interest rates?

Trump’s interest rate challenges with the Federal Reserve

JPMorgan Fed interest rate forecast 2026